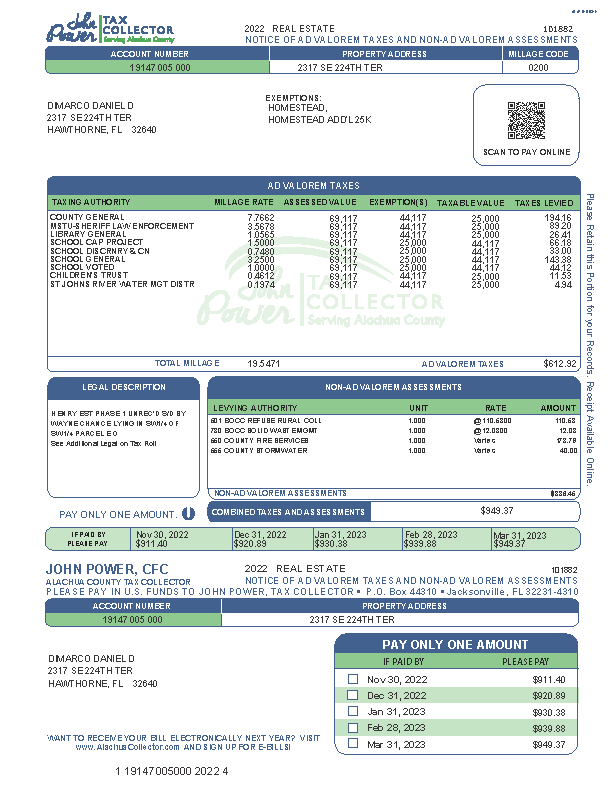

ACCOUNT NUMBER (Parcel Number) Unique number assigned to each property. Please refer to this number when making inquiries.

PROPERTY OWNER(S) & MAILING ADDRESS Verify the ownership. If you have sold this property, forward the notice to the new owner(s) or return it to the Tax Collector’s office. If your mailing address has changed, complete the change of address notice on the front page of this insert according to the instructions. Please do not write on the tax notice.

EXEMPTIONS Property owners may be eligible for exemptions and additional benefits that can reduce their property tax liability. If you have any questions regarding exemptions, contact the Property Appraisers Office at (352) 374-5230.

ASSESSED, EXEMPTION & TAXABLE Certain exemptions are only applicable to specific taxing authorities. Millage Rate, Assessed Value, Exemption Amount and Taxable Value are used to calculate the Ad Valorem Taxes Levied. If you have any questions regarding values or exemptions, contact the Property Appraiser’s Office at (352) 374-5230.

LOCATION & LEGAL DESCRIPTION This is the location and legal description of the property

NON-AD VALOREM ASSESSMENTS These assessments are based on the improvement or service cost allocated to a property such as solid waste, fire services, stormwater, or paving assessments and are levied on a benefit unit basis, rather than on value. Any questions regarding the assessment should be directed to the following levying authorities:

- Alachua County Fire: (352) 384-3101

- Alachua County Storm Water: (352) 264-6850

- City of Gainesville Fire: (352) 334-5078

- City of Newberry Fire: (352) 472-2161

- City of High Springs Fire: (386) 454-1416 #6

- City of Alachua Storm Water: (386) 418-6100

- PACE: (352) 264-6700

- BOCC Levies: (352) 338-3233

- Parker Road CDD: (407) 382-3256

TOTAL TAXES This is the gross amount due (if paid between March 1st and 31st). No discount is subtracted from this amount.

AMOUNT DUE The amount in each box reflects the discounted total taxes due if paid in that month. (The March amount is the same as the “Total Taxes”) Discounts are determined by postmark date. By paying early you will receive that respective month’s discount below:

- 4% in November

- 3% in December

- 2% in January

- 1% in February

- 0% in March

(Total Taxes are due) Taxes become delinquent on April 1st. Interest and fees will apply to late payments. We DO NOT accept personal/business checks for delinquent taxes; we require cash, a cashier’s check, money order, debit card or credit card.

AMOUNT DUE The amount in each box reflects the discounted total taxes due if paid in that month. (The March amount is the same as the “Total Taxes”) Discounts are determined by postmark date. By paying early you will receive that respective month’s discount below:

- 4% in November

- 3% in December

- 2% in January

- 1% in February

- 0% in March

(Total Taxes are due) Taxes become delinquent on April 1st. Interest and fees will apply to late payments. We DO NOT accept personal/business checks for delinquent taxes; we require cash, a cashier’s check, money order, debit card or credit card.